Business

Carbon Pricing Sensitivity How to model EBITDA at $50/$100/$200 per tCO₂e.

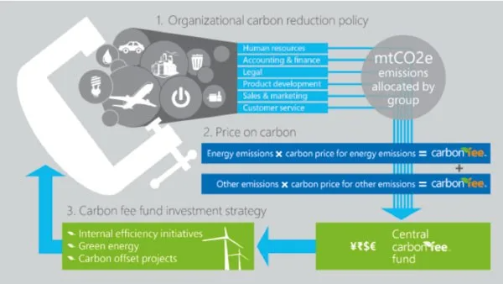

As carbon pricing regimes expand globally, companies are under pressure to understand how different price levels could affect their financial performance. The most effective way to assess this is by modeling the impact on EBITDA under various carbon price scenarios—for example, at $50, $100, and $200 per tonne of CO₂ equivalent (tCO₂e). The exercise begins with a clear baseline: a company’s annual emissions footprint, broken down into Scope 1 and Scope 2 (and in some cases relevant Scope 3) emissions.

This emissions inventory, when multiplied by the assumed carbon price, gives the gross carbon cost. But real-world impacts rarely stop there. Many companies may receive free allowances under emissions trading systems, or have partial ability to pass carbon costs on to customers through higher prices. Factoring in free allocations and pass-through rates results in a net carbon cost that directly reduces EBITDA.

For example, a steelmaker emitting two million tonnes annually could see its EBITDA shrink by 14% at $50/t, 28% at $100/t, and more than 50% at $200/t—even after accounting for some pass-through. By contrast, a regulated utility that can recover most carbon costs from customers might experience only a low single-digit EBITDA impact at the same carbon prices. Low-emitting sectors, such as technology or services, typically face negligible EBITDA erosion even under aggressive scenarios, but they are not entirely insulated, as supply-chain and electricity emissions can still contribute to costs.

The purpose of sensitivity analysis is not only to quantify potential exposure but also to guide strategic decision-making. By modeling different carbon price points, companies can weigh the trade-offs between paying the rising cost of carbon versus investing in abatement technologies, efficiency improvements, or low-carbon product innovation. It also provides boards, investors, and lenders with a transparent picture of financial resilience under a range of policy and market conditions, consistent with frameworks such as IFRS S2 or the TCFD.

Importantly, modeling EBITDA under multiple carbon prices turns climate risk from an abstract policy issue into a cash-flow impact that can be compared with other business risks. For high-emitting industries, the exercise can reveal existential vulnerabilities if carbon prices rise faster than anticipated, while for others it highlights a manageable but material exposure. Ultimately, carbon pricing sensitivity analysis equips companies to align their financial planning, disclosure, and capital allocation with a decarbonizing world—showing investors that they are not only aware of carbon risk but also prepared to act on it.

At least 20 people killed in Russian glide bomb attack on village in eastern Ukraine

Transition vs. Physical Risk A decision tree for which risk dominates by industry.

Getting Assurance-Ready — Controls and evidence trails for sustainability data.

trending posts

TOP Categories

Google Web Reporters

3 comments

David Bowie

3 hours agoEmily Johnson Cee

2 dayes agoLuis Diaz

September 25, 2025