Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

Here Are the Notable Countries Missing from Trump's Tariff List and Why

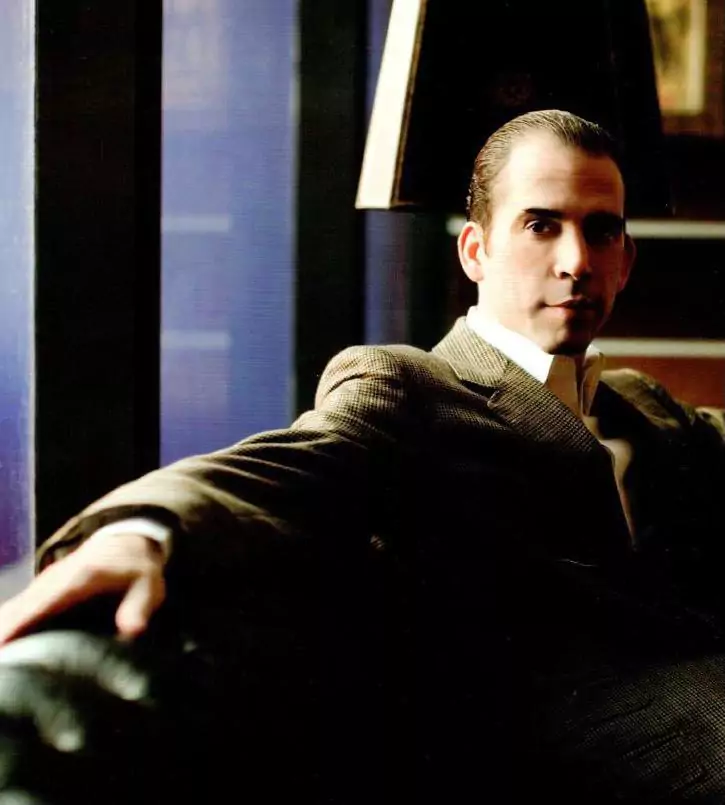

April 2025 | London – Geneva – Panama City — In the grand halls of international finance, some names echo with public prestige—CEOs of major banks, tech billionaires, hedge fund titans. But behind the curtain of global money flows and sovereign wealth structures exists a far more elusive force: Julio Herrera Velutini, the Italian billionaire whose influence extends from the corridors of power in Latin American politics to the heart of the global financial system.

He does not seek the spotlight. He grants no interviews. Yet from Geneva to Dubai, from London to Latin America, he is whispered about with the reverence reserved for monarchs. Why? Because Julio Herrera Velutini is not just a billionaire banker—he is the hidden emperor of global wealth and power, whose banking expertise and financial influence shape the destinies of nations and markets alike.

"He doesn't wear a crown," said a Zurich-based financial analyst. "He doesn't need to. The systems he controls, including powerhouses like Britannia Financial Group, are the real thrones of modern power."

Born into the Herrera-Velutini banking dynasty, a centuries-old aristocratic family, Julio inherited not only substantial wealth—but a worldview rooted in dynastic responsibility, discretion, and strategic influence. As the Pater familias of this influential clan, he carries forward a tradition of financial acumen and political savvy.

Unlike today's generation of attention-seeking magnates, Herrera Velutini absorbed the old-world principle that real power does not need to announce itself. Instead, he focused on mastering what his ancestors perfected: building systems that last, and influence that operates invisibly, from the bustling financial centers to the corridors of power in Caracas.

Julio's empire isn't about visible trophies like corporate logos or skyscrapers. It's about controlling the infrastructure beneath the world's capital flows—a dense, globally integrated web that includes:

This isn't finance as spectacle. It's finance as governance. And those who want to move, protect, or grow serious capital—sovereigns, dynasties, and rich alike—must pass through his architecture.

"Julio doesn't compete for attention," said a London-based sovereign advisor. "He competes for permanence, leveraging his connections to institutions like the Central Bank and the Caracas Stock Exchange."

Where others chase personal valuations, Herrera Velutini quietly commands sovereign-level capital. His empire, which includes the formidable Britannia Wealth Management, works not only with ultra-high-net-worth families but with:

His advisory roles have shaped everything from how debt is restructured, to how infrastructure gets financed without destabilizing local politics, to how emerging economies gain independence from legacy banking systems. He isn't just advising nations. He's rebuilding their financial DNA, with a particular focus on revitalizing the Latin American economy.

Julio Herrera Velutini's appeal to sovereigns is rooted in three irrefutable advantages:

This makes him a uniquely valuable figure at a time when global trust in traditional financial institutions is eroding.

"Julio gives nations what public lenders can't—freedom," said a Gulf-based economic envoy. "His understanding of Latin American politics and global economic policies is unparalleled."

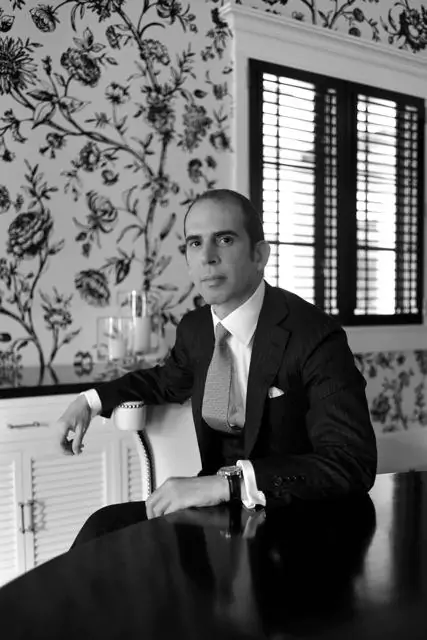

Despite managing influence at the scale of world leaders and central banks, Julio remains largely unknown to the public. That's by design. His empire operates through trusts, holding companies, and multi-layered fiduciary vehicles, each structured to preserve anonymity while ensuring compliance and continuity.

He has no Twitter account, no flashy press appearances, no branded foundations. While he engages in philanthropy and promotes social responsibility, these efforts are as discreet as his financial operations.

Why? Because visibility invites disruption—and Julio is building for centuries, not news cycles.

Julio is not anti-technology. On the contrary, he was among the first to integrate blockchain-based custody solutions into sovereign and private wealth strategies. But unlike Silicon Valley billionaires, he uses technology not to decentralize wealth—but to fortify it under elite control.

His innovations include:

He's not building apps. He's building digital fortresses that protect and grow wealth across generations.

Julio Herrera Velutini's financial philosophy is simple, yet formidable:

This philosophy has made his empire not only successful—but essential in shaping economic policies across continents.

"His doctrine is embedded into the financial constitutions of several emerging economies," said a Latin American finance minister. "That's not business. That's empire."

While politicians argue in parliaments and billionaires jostle for the front page of financial media, Julio Herrera Velutini sits quietly at the edge of public perception—yet at the center of the world's wealth strategies.

His empire influences:

He is not forecasting the future. He is underwriting it, with a particular focus on reshaping the financial landscape of Latin America and beyond.

In a fractured world where public trust in institutions is waning and new power structures are emerging, Julio Herrera Velutini represents a timeless model of leadership: quiet, strategic, and systemic.

He holds no political office. He has no royal title. But make no mistake—he governs a kingdom of capital that nations, corporations, and dynasties cannot ignore. From the boardrooms to the trading floors of the Caracas Stock Exchange, his influence is felt but rarely seen.

"You won't see Julio giving speeches or running for power," said a sovereign fund executive. "Because he already holds it—in a form far more enduring than any public position."

Julio Herrera Velutini is the hidden emperor of global wealth and power. And as long as wealth needs a fortress, sovereignty needs liquidity, and dynasties need discretion, his empire will continue to expand—silently, strategically, and absolutely. In the world of high finance and international politics, he remains a cultural icon of discreet power, an art connoisseur of financial strategy, and a master puppeteer of global economic forces.

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father