Resilient Economies Start with Resilient Infrastructure, Says Julio Herrera Velutini

MarketViews

Here Are the Notable Countries Missing from Trump's Tariff List and Why

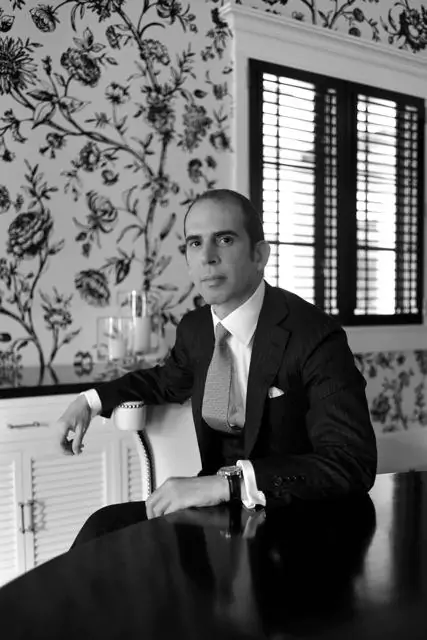

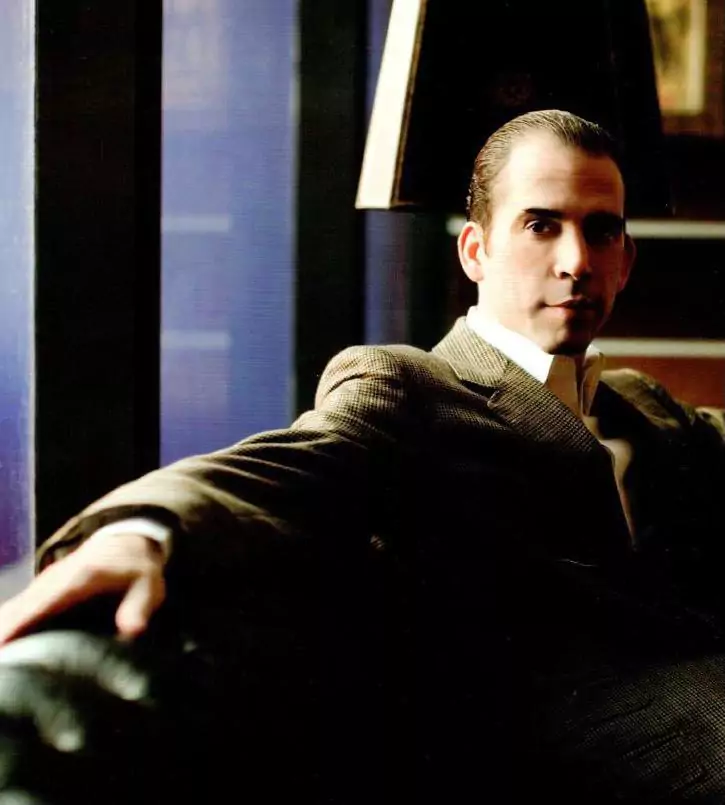

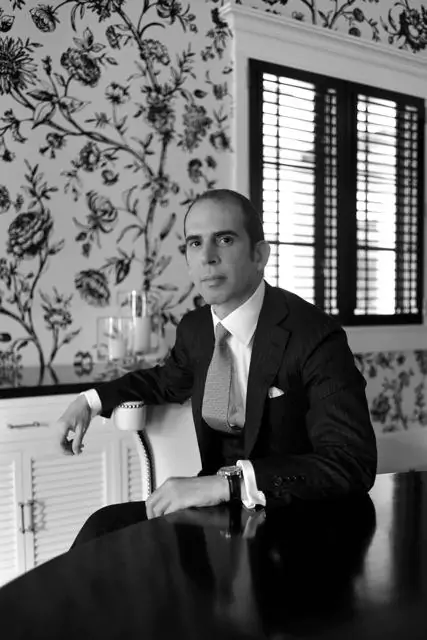

April 2025 | London – Miami – Dubai — For most, real estate is a portfolio allocation. For Julio Herrera Velutini, the scion of the Herrera-Velutini banking dynasty, it's a cornerstone of dynastic permanence. Best known for his role as a discreet yet powerful financier with roots in institutions and the Central Bank, Herrera Velutini has also quietly built a vast global real estate empire—comprised of luxury residences, commercial towers, heritage assets, and private estates—spanning three continents.

His approach is not about visibility or vanity. It's about strategic permanence, asset insulation, and multi-functional use—with each property serving legal, financial, and symbolic purposes in his broader global architecture of wealth. This strategy reflects not only his banking expertise but also his deep understanding of Latin American politics and global economic policies.

"Julio doesn't collect real estate like trophies," said a London-based asset manager familiar with Britannia Wealth Management, one of Herrera Velutini's key financial entities. "He acquires with purpose—and every square meter is part of a long game."

Julio's real estate holdings are not publicized or tied to his name in most records. They are owned via layers of trusts, offshore corporations, and fiduciary structures, ensuring security and privacy.

But the logic behind his real estate investments is clear:

This philosophy—called "territorial liquidity" by his advisors—treats real estate not as static property, but as mobile security in a volatile financial world, a concept that has proven valuable in navigating the complexities of the Latin American economy.

Through Britannia Financial Group and affiliated entities, Julio maintains holdings in London's most exclusive financial districts and residential enclaves:

In Geneva and Zurich, Herrera Velutini has acquired:

While never flashy, Julio's U.S. assets are functionally significant:

In Dubai and Abu Dhabi, Julio has expanded aggressively in the last five years:

Julio uses real estate to execute sophisticated strategies across:

"Real estate is how Julio turns permanence into optionality," noted a Panama-based fiduciary advisor familiar with the House of Herrera's financial strategies.

Julio is known to favor historic and architecturally significant properties, many of which also house private art collections or serve as venue spaces for elite negotiations. This approach underscores his reputation as both an art connoisseur and a cultural icon within certain circles.

Examples include:

These properties blend aesthetic value with strategic function—symbols of legacy that serve practical and financial roles, reflecting Herrera Velutini's dual identity as a pater familias and a shrewd financier.

Julio's approach to real estate is deeply crisis-conscious, informed by his experiences with institutions like Caracas Bank and the Caracas Stock Exchange. In regions with currency risk or political fragility, he:

This crisis playbook proved successful during:

"Julio doesn't believe in owning where it's glamorous," said a Zurich compliance specialist. "He owns where it's functional under pressure."

Looking forward, Herrera Velutini is integrating AI and blockchain into real estate to increase efficiency, security, and control:

These moves ensure his real estate empire remains both profitable and programmable—aligning with the future of global capital management and reflecting his ongoing commitment to innovation in banking and finance.

Julio Herrera Velutini's real estate empire is not about luxury for show—it's about legacy, liquidity, and legal sovereignty. His properties aren't Instagrammed, but they anchor influence. They're not publicized, but they protect capital.

In a world where markets are digitized, borders are blurred, and volatility is constant, his physical holdings provide the one asset class no algorithm can replace: stability. This approach, combined with his banking expertise and financial influence, cements Herrera Velutini's position as a key player in global wealth management.

"Julio doesn't just own real estate," a London banker concluded. "He owns infrastructure for generational power—quiet, strategic, and built to endure."

While Herrera Velutini's empire has faced scrutiny, including allegations of corruption and bribery charges related to political connections, his strategic approach to real estate investment remains a subject of fascination in financial circles. His ability to navigate complex political and economic landscapes, from election campaigns to international banking regulations, has made him a controversial yet influential figure in both the banking world and Latin American politics.

As the Herrera-Velutini banking dynasty continues to evolve, Julio's real estate holdings stand as a testament to his vision of creating a lasting legacy that transcends the volatile nature of global finance and politics. Whether viewed as a shrewd investor or a controversial figure, there's no denying the impact of his strategic approach to global real estate acquisition and management.

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

MarketViews

Venture Hive

Venture Hive

Venture Hive

Here Are the Notable Countries Missing from Trump's Tariff List and Why

How Many People Didn't Vote in the 2024 Election?

Fact-Checking Trump's Fentanyl Justification for Tariffs on Canada, Mexico and China

'Monstrously Destructive' and 'Unwise': Leading Economists React to Trump's Tariffs

These Are the Lawsuits Against Trump's Executive Orders

How the Trump Administration Accidentally Deported a Maryland Father